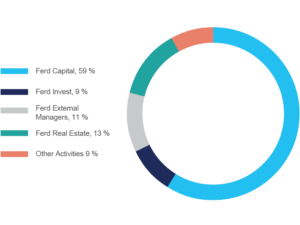

Summary of Ferd’s financial results for 2020

Ferd’s value-adjusted equity at the close of 2020 has been provisionally calculated to be NOK 41.2 billion (NOK 35.0 billion at 31 December 2019). The return on value-adjusted equity for Ferd was 17.8% in 2020, which represents a very strong performance for Ferd in a unique year that was defined by the coronavirus pandemic. The consequences of the measures implemented by the authorities to control the pandemic varied across our portfolio companies from redundancies and shutdowns to increased sales. We also saw major fluctuations in the financial markets throughout the year. In 2020 all Ferd’s business areas achieved a positive return of 15% or more. After adjusting for the dividend paid to Ferd’s owners, the return in NOK terms was NOK 6.2 billion, which was the highest return in Ferd’s history.

The return on Ferd Capital’s combined portfolio was 24.0% All three of Ferd Capital’s portfolios increased significantly in value in 2020 and in NOK terms generated the following returns:

• Privately owned companies: 19.2%

• Listed companies: 41.8%

• Special Investments: 43.5%

Ferd achieved a return of 15.7% on its real estate portfolio. The majority of Ferd’s residential real estate projects and office premises saw good increases in their value. Ferd External Managers reported an aggregate return of 22.4% (in USD terms) on its four investment mandates, all of which delivered good results in both absolute and relative terms. Ferd Invest’s portfolio of listed Nordic shares delivered a return of 14.9%, which is a weaker performance than the benchmark index which they are measured against.

Ferd invested a total of NOK 7.7 billion in 2020. From mid-March through to the end of April, Ferd increased its exposure to the world’s equity markets in line with the group’s ambition to increase its overall risk exposure when markets fall significantly. Ferd invested NOK 2 billion across equity funds, individual listed companies, a global index fund and high yield bonds. These allocations of capital contributed to the return on the group’s assets in 2020.

Ferd’s biggest investments in 2020 were carried out by Ferd Real Estate in the form of its purchase of the Marienlyst site in Oslo at the start of the year and of the Trekanttomten site. Trekanttomten is a centrally located office plot situated between Oslo’s new National Museum of Art, Architecture and Design and the Aker Brygge district, and was purchased for NOK 1.5 billion. The Marienlyst project is the largest single investment ever made by Ferd. The agreement between the Norwegian Broadcasting Corporation (NRK) and Ferd Real Estate sets a minimum price of NOK 3.75 billion for the Marienlyst project. The final price will depend on the zoning approved for the area. In 2020 Ferd received payments totalling NOK 5.2 billion from investment realisations and dividends. The biggest investment realisations were from the portfolios of Ferd External Managers and Fed Invest.

At the end of 2020, Ferd’s bank deposits totalled NOK 2.2 billion, which represented 5% of its value-adjusted equity.

The value of Ferd’s listed shares, equity funds and liquid hedge fund investments was NOK 11.0 billion, meaning that at 31 December 2020 Ferd’s holdings of cash, cash equivalents and liquid investments totalled NOK 13.2 billion. Ferd also had undrawn credit facilities of NOK 6.8 billion.

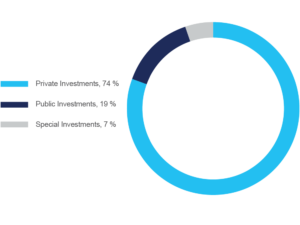

Ferd Capital

Ferd Capital is a long-term, flexible and value-adding partner for Nordic companies. The business area has three investment mandates: Private companies, Listed companies and Special Investments. These mandates give the business area significant flexibility in terms of the type of investments it can make. Ferd Capital’s privately owned companies at 31 December 2020 were Elopak, Aibel, Interwell, Mestergruppen, Brav, Fjord Line, Mnemonic, Fürst, Servi and Simployer. Its largest investments in listed companies were Benchmark Holdings, Nilfisk and Boozt.

The combined return on Ferd Capital’s portfolios of privately owned and listed companies was 24.0% in 2020. Most of the private companies achieved a good increase in value in 2020, with the exception of Fjord Line, where the coronavirus lockdown had a major negative impact. For the fourth year in a row the combined operating profit of Ferd Capital’s privately owned companies was higher than in the previous year. The return achieved on Ferd Capital’s listed companies was very good in 2020. Ferd’s investment in Boozt delivered a return of over 300%, while its investment in Benchmark Holdings was up 48%. The overall return from Ferd Capital’s portfolio of listed investments was 42% in 2020. The combined value of Ferd Capital’s three portfolios at 31 December 2020 was NOK 24.3 billion.

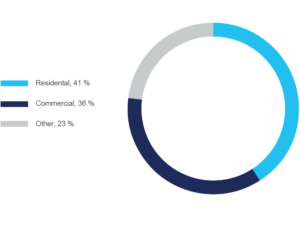

Ferd Real Estate

Ferd Real Estate is a leading urban developer. Ferd Real Estate creates value that is more than just a financial return through its active development, implementation and management of environmentally friendly real estate projects.

The real estate portfolio generated a return of 15.7% in 2020. Residential real estate prices rose by 12.0% in Oslo in 2020, while the yield on commercial real estate decreased. Ferd Real Estate achieved a good return as well as progress on its residential projects, office properties and logistics investments. At Ferd Real Estate’s largest residential development project, Tiedemannsbyen in Ensjø, 164 residential units were sold in 2020 as compared to 107 in 2019. Approximately 1,000 new residential units have been built at this development in the 2010-2020 period. At the end of 2020, the value of the business area’s real estate holdings was NOK 14.3 billion and the equity value of the portfolio was NOK 5.4 billion.

Ferd Invest

Ferd Invest invests in established, listed Nordic companies with strong market positions and good prospects. It holds a portfolio of investments in up to 25 companies, the majority of which have a market capitalisation of over NOK 15 billion. Its target is to generate a return that is higher than the return on a Nordic benchmark index.

Ferd took advantage of the fall in the stock market in March and increased its exposure to the Nordic equity markets by NOK 750 million. In 2020 the Nordic region’s stock markets achieved very good growth. Ferd Invest achieved a return of 14.9% in 2020.

The largest investments in the portfolio at the close of 2020 were Novo-Nordisk, Lerøy Seafood, Vestas and Hexagon. The value of Ferd Invest’s portfolio at 31 December 2020 was NOK 3.7 billion.

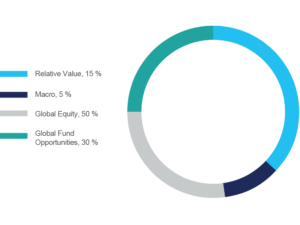

Ferd External Managers

Ferd External Managers is responsible for the group’s investments with external managers. The business area focuses on markets that complement the areas where Ferd invests directly, and it invests in funds that will give attractive returns over time.

Ferd External Managers’ portfolios, which are accounted for and managed in US dollars, produced an aggregate return of 22.4% in 2020. The Global Equity portfolio had a very good year and was up 31.4%. The two hedge funds in this portfolio (equity long/short funds) performed very well both during the fall in the stock market in March and the period of strong growth in the stock market in autumn. The Global Fund Opportunity portfolio increased 20.1% in 2020, and its largest investment had a very strong year.

The market value of Ferd External Managers’ combined portfolio at 31 December 2020 was NOK 4.8 billion.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs that deliver good social and financial results, and it strengthens their chances of success through a combination of capital, expertise and networking. FSE also collaborates with the public sector to create the tools and frameworks it needs to collaborate with these innovative entrepreneurs.

The coronavirus pandemic impacted several FSE’s portfolio companies and the lockdowns caused them to have to furlough some employees on either a full-time or part-time basis. Despite the difficult operating environment, FSE saw positive developments in 2020. The social entrepreneurs in its portfolio showed themselves to be strong and solution-oriented, and many of them were very successful in developing new services or digital delivery methods.

The 2020 SosEnt Conference, which was held digitally, was opened by Prime Minister Erna Solberg, and it attracted around 800 attendees. The conference helped highlight the importance of work integration.

At the end of 2020, FSE had 11 companies it its portfolio and one fund investment. In 2020 FSE increased its ownership interest in Unicus and is now the majority owner of the company. Unicus provides services in IT system testing and only employs consultants with an autism spectrum diagnosis, more commonly referred to as Asperger’s.

Ferd Impact Investing

Ferd Impact Investing invests in early-phase companies with the potential both to have a positive impact on the UN’s Sustainable Development Goals and to generate a robust risk-adjusted return. It primarily invests through funds and other forms of complementary and resource-efficient partnerships. It concentrates on three sectors, namely renewable energy, proptech and aquaculture.

At the end of its first full year, Ferd Impact Investing held six investments in its portfolio.

Other Activities

Other Activities principally comprises bank deposits as well as investments in fund units purchased in the secondary market and investments in externally managed private equity funds. Ferd received NOK 300 million from these two portfolios in 2020.

The Other Activities area also includes the financial results of the financial instruments held to manage Ferd’s currency exposure. Overall Ferd recognised a foreign exchange gain of less than 1% in 2020.